Providing an exceptional customer experience has become paramount in attracting and retaining clients. And it can have a profound impact on the success of physical therapy clinics. Explore the key factors that contribute to a positive customer experience below and learn how they can revolutionize your clinic’s reputation and growth.

Have more questions? We’ve run quite a few clinics ourselves — and consult on dozens and dozens more. We’ve seen a thing or two and would be pleased to chat with you about your challenges. Reach out! We are here.

We’ve heard the adage that happy employees make happy customers, but new data reveals just how significant the impact of the employee experience is — and how to use it to unlock organizational growth.

Decades of business strategy have urged leaders to concentrate the bulk of their business efforts on the customer experience. A recent Columbia study found “that executives talk about customers 10 times more often [in earnings calls] than employees. And when they do, executives perceive customers to be analogous to opportunities and employees to risks.” And even when companies talk about a good employee-experience game, they still actually act on customer experience.

While prioritizing customers over employees can drive short-term revenue growth, it will cost companies in long-term employee retention and engagement. According to research by Salesforce colleagues and I conducted, a company could increase revenues by up to 50% by improving the employee experience.

I wanted to identify the key drivers of the employee experience in order to help executives improve it. For my forthcoming book, The Experience Mindset, my colleagues and I conducted a new study of thousands of employees and executives from around the world and across multiple industries. Using regression analysis, we pinpointed the five most important factors in creating a better employee experience:

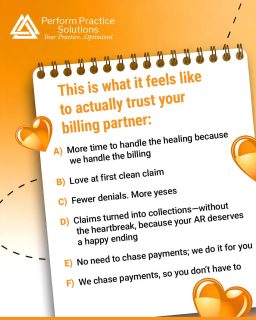

1. Mutual trust

There are two kinds of trust: your employees’ trust in your organization and your organization’s trust in its employees.

Mutual trust results in employee empowerment. It demonstrates management’s confidence in its workforce, which fuels employees’ trust in leadership and each other. It also motivates employees, promotes creativity and collaboration, improves retention, and reduces risk aversion, all helping the bottom line. That empowerment and trust is evident at companies like Apple, where store employees needn’t request special approvals to solve many customer problems, and Ritz-Carlton, where workers can spend up to $2,000 to fix a guest issue without managerial approval.

Mutual trust also helps workers feel heard. According to McKinsey, that kind of inclusion leads to a 47% increased likelihood that employees will stay with a company and a 90% increased likelihood they’ll go out of their way to help each other.

When Clear Co, a Toronto-based financial lending firm, started experiencing hyper-growth, CEO Michele Romanow wanted to modernize its processes while maintaining its entrepreneurial culture. So she set up an email inbox with the colorful title, “The stupid sh*t we do!” and asked employees for ideas on streamlining the business and removing preventable frustrations.

According to Romanow, this simple exercise accomplished two goals. First, it gave employees a sense of ownership and involvement in improving their day-to-day lives and helping the company. Second, it created a feedback loop permitting leadership to build employee trust while surfacing and addressing issues before they metastasized.

2. C-suite accountability

Closely related to trust, C-suite accountability means ensuring company leadership is committed and responsive to both the business and its workers.

On one level, accountability is about a willingness to ask questions and actively listen to the answers. A leader can’t address employee needs they don’t know about. More broadly, it speaks to culture: An enterprise with strong C-suite accountability understands the importance of employee experience and prioritizes it.

There’s often a difference between companies’ talk and their actions. We found in our research that while 49% of C-suite executives believed their company excels at acting on employee feedback (honestly, a low number), only 31% of workers agreed. That gap can swallow growth, momentum, and talent.

Create a culture in which everyone understands that employee experience is a collective responsibility. Hilton, for example, established cross-functional teams that ensure a formal, structured way for the C-suite to keep tabs on employee experiences. As Chris Silcock, Hilton’s EVP and chief commercial officer, has observed, “How you treat your team members guides how they treat your customers.” Hilton has repeatedly been named one of Fortune’s “Best Companies to Work For.”

At your company, this could look like an experience advisory board to help break down traditional barriers and facilitate brainstorming and ideation; a center of excellence to deliver best practices where there are knowledge or skills gaps; employee resource groups to provide peer-to-peer counseling and boost career development; or “voice of the employee” surveys to solicit and gather employees’ needs, wants, and expectations.

3. Alignment of employee values and company vision

Employees want to align with their company’s values, but that makes the C-suite responsible for clearly enunciating them — and then making sure corporate actions are consistent with them.

Clear goals with well-defined milestones and success metrics connect employees to their company’s mission and help them understand their role in advancing it. We found in our research that ensuring employees feel valued and core to the company vision is a significant driver of reported increases in revenue. However, only 36% of employees reported feeling that way.

A company culture that supports an experience mindset understands the intrinsic connection between what it does internally for employees and how that translates into its customers’ experiences. Airbnb, for example, hired the first head of employee experience at a major U.S. corporation, in 2013. “Culture is simply a shared way of doing something with passion,” CEO Brian Chesky wrote then in a Medium post titled “Don’t F*^k Up the Culture.” “The stronger the culture, the less corporate process a company needs. When the culture is strong, you can trust everyone to do the right thing.”

Alignment is a major part of that culture, starting before employees even join Airbnb. The company conducts two separate “core values interviews” run by team members outside of the hiring function so they can assess cultural fit independent of the job opening’s specific needs.

4. Recognizing success.

As the activist and philanthropist Lynne Twist has observed, “What you appreciate appreciates.” Recognition can be a cost-effective way to boost employee engagement, which has positive spillover effects on loyalty, retention, and productivity. Workers who believe their success will be recognized are 2.7 times more likely to be highly engaged than peers who don’t, according to the employee engagement firm Quantum Workplace.

Praise is not the sum total of recognition, of course. It also involves identifying and nurturing potential, giving employees the skills needed to grow. Unilever, for example, created a leadership development program encompassing the entire organization. In leadership development workshops, employees create individually tailored “future fit plans,” each focused on a purpose that’s both important to the individual and in keeping with company goals. The result? Ninety-two percent of those who attended a workshop said that their jobs inspire them to go the extra mile, while only 33% of those who had not attended felt the same way.

5. Seamless technology to reduce employees’ day-to-day friction

Too often, executives throw technology at problems as a way to fix company performance, productivity, and costs but give too little thought to how it fits into the rest of the organization’s infrastructure, existing processes, and people’s workflows. As engineer and management consultant W. Edwards Deming put it almost 40 years ago, “Eighty-five percent of the reasons for failure are deficiencies in the systems and process rather than the employee. The role of management is to change the process rather than badgering individuals to do better.”

A common employee complaint is the sheer volume of applications they need to navigate between to do their work. Enterprises use an average of more than 1,000 different applications, only 29% of which are integrated (i.e., communicate with one another).

Technology is not an end in itself but a tool for increasing productivity and reducing effort. And yet our research shows that technology is one of the most poorly rated dimensions of employee experience: Fewer than one in three employees said their company’s technology works effectively, and fewer than one in four said they’re equipped with seamless technology. Even the C-suite gets this: Only 52% of executives said that their company provides employees with tech that works effectively.

Can you imagine asking your customers to toggle between multiple tabs just to place an order with you? Probably not — most companies work hard to reduce this kind of friction for customers. Yet that’s what we ask of our employees every day when the systems they use aren’t integrated. The result is reduced satisfaction and a terrible employee experience. We must ensure that both the customer experience and employee experience get equal resources. Saving customer time nets out little or no gain if you’re shifting that effort to your employees.

Revitalize the Employee Experience

Covid-19 and the Great Resignation inspired workers to reevaluate their priorities and empowered them to act. That has spurred companies to relearn what was once a given: that their most valuable resource is their people.

What began as a wakeup call for how leaders can save their companies from a talent exodus can also be an opportunity for growth and competitiveness — but only if they learn to balance their customers’ experiences with those of their workers by focusing on trust, C-suite accountability, alignment, recognition, and technology.

These five elements are intertwined. Each builds on the others to establish a stronger employee experience and unleash new value. Happy workers make happy customers, and managing the nexus between the two will make leaders and investors happy, too.

Take your physical therapy clinic to the next level by prioritizing the customer experience. We are dedicated to selling efficient physical therapy marketing solutions and helping clinic owners achieve their goals. Give us a call at (833) 764-0178 and visit our IG @performpracticesolutions

Reference: [https://hbr.org/2023/07/5-factors-that-make-for-a-great-employee-experience?ab=HP-latest-text-3]